Japan Open Chain Announces Next Hardfork “Tokyo Hardfork”

〜 Long-term Roadmap Unveiled, Native Token Unified Under the Name “JOC COIN” 〜 Japan Blockchain Foundation Co., Ltd. (President: Daimei Inaba, hereinafter referred to as “the Foundation”) today announced the long-term development roadmap (2025–2030 and beyond) for its public blockchain Japan Open Chain and disclosed the details of the upcoming hardfork, “Tokyo Hardfork”. In addition, the Foundation has unified the name of its native token, previously registered as Japan Open Chain Token, under the widely used and familiar name “JOC COIN.” By adopting a more intuitive and memorable name, JOC COIN will enhance recognition and perception of asset value among users worldwide, accelerating its adoption as both a means of payment and an investment vehicle. Based on this roadmap, Japan Open Chain is expected to evolve into next-generation global financial infrastructure as an Ethereum-compatible Layer 1 blockchain, delivering world-class throughput, post-quantum security, and an innovative governance model.

〜 Long-term Roadmap Unveiled, Native Token Unified Under the Name “JOC COIN” 〜

Japan Blockchain Foundation Co., Ltd. (President: Daimei Inaba, hereinafter referred to as “the Foundation”) today announced the long-term development roadmap (2025–2030 and beyond) for its public blockchain Japan Open Chain and disclosed the details of the upcoming hardfork, “Tokyo Hardfork”.

In addition, the Foundation has unified the name of its native token, previously registered as Japan Open Chain Token, under the widely used and familiar name “JOC COIN.” By adopting a more intuitive and memorable name, JOC COIN will enhance recognition and perception of asset value among users worldwide, accelerating its adoption as both a means of payment and an investment vehicle.

Based on this roadmap, Japan Open Chain is expected to evolve into next-generation global financial infrastructure as an Ethereum-compatible Layer 1 blockchain, delivering world-class throughput, post-quantum security, and an innovative governance model.

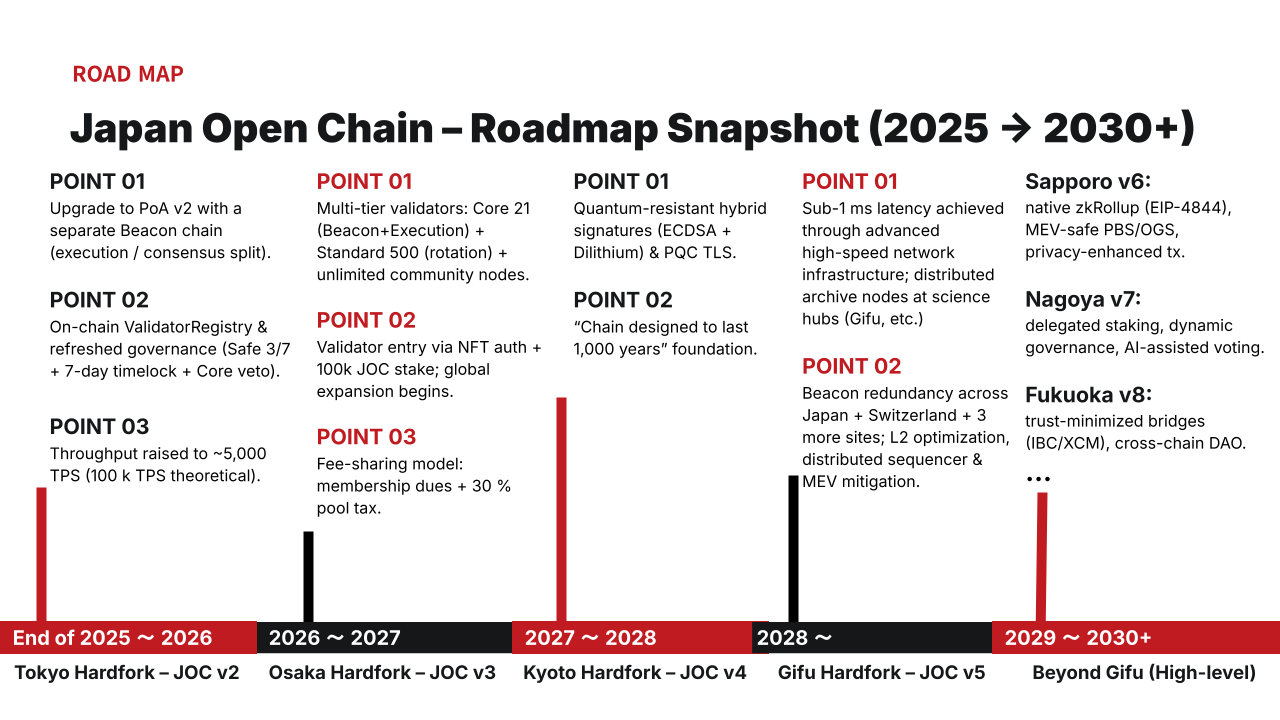

◽️ 1. Roadmap Overview

Japan Open Chain has set forth a roadmap spanning 2025 through 2030 and beyond, implementing phased hardforks and feature upgrades:

-

Tokyo Hardfork (End of 2025 – 2026): Transition to PoSA (PoA v2), synchronized with Ethereum “Prague/Electra,” targeting up to 5,000 TPS

-

Osaka Hardfork (2026 – 2027): Expansion to 21 core validators and 500 standard validators, staking up to 50 million JOC

-

Kyoto Hardfork (2027 – 2028): Strengthened post-quantum security, further validator decentralization, enhanced disaster resilience

-

Gifu Hardfork (2028 and beyond): Reduced latency leveraging Japanese technologies such as IOWN, distributed permanent storage layer

-

Beyond Gifu (2029 – 2030+): Gradual introduction of zkRollup, dynamic governance, cross-chain bridges and other advanced features

Through these upgrades, Japan Open Chain will solidify its position as next-generation financial infrastructure, combining world-class performance, post-quantum security, and innovative governance.

◽️ 2. Roadmap Details

Tokyo Hardfork – Japan Open Chain v2(2025 - 2026)

Scheduled for late 2025 to 2026, the Tokyo Hardfork will transition from Clique PoA to a new PoSA mechanism (PoA v2) leveraging a beacon chain similar to Ethereum Mainnet PoS, with Nethermind nodes as validator nodes. This will synchronize with Ethereum’s latest version “Prague/Electra,” further enhancing compatibility.

In addition, the underlying infrastructure will be prepared to harness the latent processing capability of over 100,000 TPS offered by Nethermind nodes. Practically, the gas limit will be tuned considering storage constraints, initially raising network throughput to up to 5,000 TPS.

This performance far surpasses Ethereum Mainnet (〜15–20 TPS), Polygon and similar sidechains (hundreds of TPS), and even high-performance chains such as Solana. With a scalable potential of 100,000 TPS, Japan Open Chain is positioned to handle future transaction growth. This will enable competitive advantages in high-frequency, high-reliability use cases including stablecoin issuance by financial institutions, tokenized equities and real estate trading, large-scale on-chain gaming, and international remittances.

-

Separation of execution and consensus layers through PoA v2 + Beacon Chain

-

On-chain Validator Registry introducing a new governance model

-

Throughput targeted at up to 5,000 TPS (theoretical maximum over 100,000 TPS)

With this phase, Japan Open Chain will be well-positioned for adoption in high-frequency and high-reliability sectors, while on-chain governance mechanisms will reinforce transparency and long-term operational trust.

The name “Tokyo” was chosen as Japan’s capital and financial hub, symbolizing leadership in the global financial ecosystem.

Osaka Hardfork – Japan Open Chain v3(2026 - 2027)

This hardfork will introduce a multi-tier validator structure with 21 core validators and up to 500 standard validators. Governance will remain manageable under core validators, while significantly enhancing decentralization and resilience.

-

Multi-tier validators (Core 21, Standard 500)

-

Validator participation via NFT authentication + staking

-

Up to 50 million JOC staked with a 100,000 JOC deposit requirement

Standard validators will be approved through consortium review, issuance of an authentication NFT, and meeting staking requirements. This will open participation to overseas validators, dramatically improving decentralization and fault tolerance. The fee-sharing model will expand staking demand, creating greater potential demand for JOC COIN.

The name “Osaka” was chosen in reference to the Expo, symbolizing global participation from around the world.

Kyoto Hardfork – Japan Open Chain v4(2027 - 2028)

This hardfork advances the design concept of a “1,000-year blockchain,” strengthening post-quantum security and enhancing disaster resilience through further validator decentralization and domestic server distribution.

-

Post-quantum cryptography introduction

-

Further decentralization of validator community governance

-

Strengthened domestic server geographic distribution

With quantum resistance, long-term assets and national-level critical data can be securely preserved, accelerating adoption in highly regulated fields such as government and financial institutions.

Named after “Kyoto”, Japan’s ancient capital lasting over 1,000 years, symbolizing durability and legacy.

Gifu Hardfork – Japan Open Chain v5(2028 - 2029)

This hardfork will reduce consensus latency through adoption of Japanese technologies such as NTT’s IOWN, and achieve distributed permanent storage in stable domestic and international regions.

-

Reduced consensus latency via high-speed network infrastructure

-

Distributed permanent storage layer

-

Beacon redundancy across Japan, Switzerland, and other stable locations; L2 optimization

By achieving extremely low latency and high availability, Japan Open Chain will support high-frequency trading, IoT communications, and real-time interactions in metaverse environments. These performance improvements will greatly enhance user experience and accelerate ecosystem expansion.

Named after “Gifu”, home to advanced science facilities and known for strong geological foundations, symbolizing resilience.

Beyond Gifu(2029 – 2030 and beyond)

Future plans remain under review but are expected to include annual technical and operational upgrades.

Planned hardforks include:

-

Sapporo v6: Native zkRollup, MEV-safe design, privacy enhancements

-

Nagoya v7: Delegated staking, dynamic governance, AI-assisted voting

-

Fukuoka v8: Trust-minimized cross-chain bridges (IBC/XCM), cross-chain DAO

※Note: These plans are subject to change.

◽️ 3. Token Rebranding – JOC COIN

Effective September 1, 2025, as part of a global brand strategy to enhance international recognition, the native token formerly known as Japan Open Chain Token will be unified under the more intuitive and pronounceable name “JOC COIN”.

This rebranding not only improves recognition among developers, users, and investors, but also highlights JOC COIN’s role as a settlement medium and an investable digital asset. By aligning with globally recognized naming conventions like Bitcoin, JOC COIN is expected to gain wider traction in global markets

◽️ 4. Future Outlook

Japan Open Chain will leverage its strengths, Ethereum compatibility combined with the trust of Japanese corporate governance, to become a next-generation global financial infrastructure by 2030. By uniting advanced technology with the reliability of Japanese enterprises, the network will provide a secure, sustainable, and globally competitive blockchain ecosystem.

◽️ "Japan Open Chain": A Blockchain Originating from Japan

Japan Open Chain is a practical, Ethereum-compatible (Layer 1) public blockchain operated by Japanese companies. Together with leading industry giants and Web3 innovators, it aims to provide a secure, high-speed, and low-cost blockchain infrastructure accessible to users worldwide. This project seeks to revolutionize global digital finance by building future financial infrastructure through initiatives like bank-led stablecoin projects and the digitization of assets such as NFTs.

The blockchain is currently operated by 14 validators (blockchain operation partners), includingDentsu Inc.; NTT Communications from the NTT Group; G.U.Technologies, Inc.; insprout Corporation; Kudasai Co., Ltd.; pixiv Inc.; TIS Inc.; extra mile Inc., a TV Asahi Group company; Kyoto University of the Arts; Hatena Co., Ltd.; CAC Corporation; CYBERLINKS CO.,LTD.; SBINFT Co., Ltd.; Pacific Meta Inc. and Nethermind. The blockchain is managed in a decentralized manner and is expected to expand to 21 validators in the future.

◽️ About Japan Blockchain Foundation Co., Ltd.

The Japan Blockchain Foundation Co., Ltd. operates and manages the consortium for "Japan Open Chain," a business-oriented blockchain designed to address social challenges through blockchain technology. This initiative is run by trusted Japanese companies in compliance with Japanese law. To ensure the safe and appropriate use of blockchain technology, the foundation develops and operates various types of blockchains tailored to business objectives, including private chains, consortium chains, and public chains.

[Company Overview] Company Name :Japan Blockchain Foundation Co., Ltd. Location :26-1 Sakuragaoka-cho, Shibuya-ku, Tokyo, Japan Representative :President & CEO/CTO, Daimei Inaba Founded :July, 2022 URL :https://www.jbfd.org/en/ Business Overview :Operation and Management of Web3 Infrastructure

◽️ For Inquiries Regarding This Press Release

We welcome interview and speaking engagement requests. Please feel free to reach out.

Japan Blockchain Foundation Co., Ltd. - Public Relations

Inquiry Form: https://www.japanopenchain.org/contact